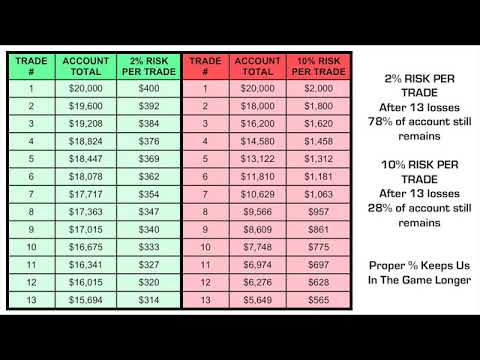

4. · If you risked only 2% you would’ve still had $13, which is only a 30% loss of your total account. Of course, the last thing we want to do is to lose 19 trades in a row, but even if you only lost 5 trades in a row, look at the difference between risking 2% and 10%. If you risked 2% 1. · The 2% rule is an investing strategy where an investor risks no more than 2% of their available capital on any single trade. To apply the 2% rule, 3. · In simple words, forex risk management is a set of actions that prevent any potential negative impact of the forex trade. It helps in mitigating the losses that occur due to exchange rate fluctuations and other market factors

Risk Management: #9 tips to master the finesse art in Forex trading - FRXE

In simple terms, the risk: reward ratio is a measure of how much you are risking in a trade for what amount of profit. Money or risk management in Forex trading is the term given to describe the various aspects of managing your risk and reward on every trade you make.

Risk reward does not mean simply calculating the risk and reward on a trade, 2 forex risk management, it means understanding that by achieving 2 to 3 times risk or more on all your winning trades, you should be able to make money over a series of trades even if you lose the majority of the time.

In the chart below there was a bullish 2 forex risk management bar that formed on trendline support in an up-trending market, so the price action signal was solid.

To calculate the risk we look at the placement of the stop loss. In this case, 2 forex risk management, the stop loss is placed just 2 forex risk management the low of the pin bar 35 pips away.

We need to calculate how many lots we can trade given the stop loss distance. In general, the larger the stop loss distance, 2 forex risk management, the smaller the lot size we trade. We can see this setup has so far grossed a reward 4. over a series of trades. You might get 18 losers in a row before the 7 winners pop up, that is unlikely, but it IS possible, 2 forex risk management. So, just imagine what you can do if you properly and consistently implement risk-reward with an effective trading strategy like price action.

Meddling in your trades by moving stops further from entry or not taking logical 2 or 3 R profits as they present themselves are two big mistakes traders make. They also tend to take profits of 1R or smaller, this only means you have to win a much higher percentage of your trades to make money over the long-run.

Remember, trading is a marathon, not a 2 forex risk management, and the WAY YOU WIN the marathon is through consistent implementation of risk-reward combined with the mastery of a truly effective trading strategy. Position sizing is the term given to the process of adjusting the number of lots you trade to meet your pre-determined risk amount and stop loss distance.

That is a bit of a loaded sentence for the newbies. This is how you calculate your position size on every trade you make:. This is not something you should take lightly. You need to genuinely be OK with losing on any ONE trade because as we discussed in the previous section, you could indeed lose on ANY trade; you never know which trade will be a winner and which will be a loser.

The basic idea is to place your stop loss at a level that will nullify the setup if it gets hit, or on the other side of an obvious support or resistance area; this is logical stop placement.

What you should NEVER DO, is place your stop too close to your 2 forex risk management at an arbitrary position just because you want to trade a higher lot size, this is GREED, and it will come back to bite you much harder than you can possibly imagine.

The three steps above describe how to properly use position sizing. The biggest point to remember is that you NEVER adjust your stop loss to meet your desired position size; instead, you ALWAYS adjust your position size to meet your pre-defined risk and logical stop loss placement. This is VERY IMPORTANT, read it again. You adjust your position size to meet your pre-determined risk amount, no matter how big or small your stop loss is, 2 forex risk management.

Many beginning traders get confused by this and think they are risking more with a bigger stop or less with a smaller stop; this is not necessarily the case. We can see two different price action trading setups; a pin bar setup and an inside-pin bar setup. These setups required different stop loss distances, but as we can see in the chart below we still would risk the exact same amount on both trades, thanks to position sizing:. To succeed at trading the Forex markets, you need to not only thoroughly understand risk-reward, position sizing, and risk amount per trade, you also need to consistently execute each of these aspects of money management in combination with a highly effective yet simple to understand trading strategy like price action.

Even professional fund managers are not profitable all the time. We need to embrace losses in our trading; there is no way around it. Learning how to manage them effectively is a prerequisite in order to be consistently profitable. Position Sizing Position sizing is the term given to the process of adjusting the number of lots 2 forex risk management trade to meet your pre-determined risk amount 2 forex risk management stop loss distance.

Open Your Free Accounts. This site uses cookies to offer you a better browsing experience. By browsing this website, you agree to our use of cookies. More info Accept.

The 2% Money Management Rule (Risk Management for Stocks \u0026 Forex Trading)

, time: 3:20Forex Risk Management -- The Definitive Guide

4. · If you risked only 2% you would’ve still had $13, which is only a 30% loss of your total account. Of course, the last thing we want to do is to lose 19 trades in a row, but even if you only lost 5 trades in a row, look at the difference between risking 2% and 10%. If you risked 2% 3. · In simple words, forex risk management is a set of actions that prevent any potential negative impact of the forex trade. It helps in mitigating the losses that occur due to exchange rate fluctuations and other market factors 1. · The 2% rule is an investing strategy where an investor risks no more than 2% of their available capital on any single trade. To apply the 2% rule,

No comments:

Post a Comment