The Best Forex Broker with High Leverage in FP Markets (blogger.com) is TrustedBrokers' Best Forex Broker With High Leverage in Leverage up to across 60+ currency pairs. FP Markets supports all trading styles and Expert Advisors, including scalpers and trading robotos 3/30/ · This way, if leverage is used, a trader would be making USD instead of 1 USD. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain them. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading blogger.comted Reading Time: 7 mins 12/14/ · If you have realized anything about forex trading or forex brokers, its that most offer an extreme amount of leverage. It is very common to see leverage of to or even more. Brokers that offer its clients or more leverage can be dangerous to unexperienced traders

Leverage Forex Trading Brokers

Whether you are a newbie trader on the Forex market or have solid experience, you have certainly already encountered the concept of leverage. If you are just discovering Forex trading, you may be wondering what exactly this term means. Since leading brokers around the world offer different leverage ratios on Forex, here we will review the main points of trading with this financial tool and try to answer the question: What is a good leverage ratio?

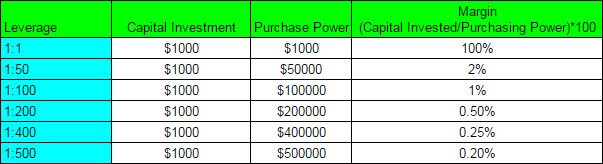

But first, forex 500 leverage, let's define the key concept. Leverage on Forex is the amount of trading funds that the broker is willing to lend to your investment based on the ratio of your capital to the amount of credit funds. The total amount of leverage provided by the broker is not constant. Brokers set their rates, which in some cases can reach or even more. Forex leverage is mostly expressed as a ratio.

Let's figure out what is the best leverage level for a beginner. Many newbies are attracted to the leverage-based earning strategy as they want to make more money in a short period of time.

However, remember that leverage is associated with certain risks. You need to at least understand the concepts that are directly related to money management in leveraged trading, such as:. If any of these concepts is unfamiliar to you, be sure to read this article for a detailed description with clear examples, forex 500 leverage. Using leverage on Forex gives traders the opportunity to forex 500 leverage their initial investment in order to play big, forex 500 leverage.

For example, a trader who has only 1 thousand dollars on their account can actually trade on the Forex market with 50 thousand dollars with a leverage of or thousand dollars using a leverage of This means you have the opportunity to open more trades in various trading instruments and apply hedging techniques for additional protection against risks hedging and its strategies are discussed in forex 500 leverage here.

This allows you to diversify your portfolio, reduce risks, and increase the chances of making a profit. Let's look at this advantage using the previous example - you have 1, dollars on your account. you trade Under these conditions, at best, forex 500 leverage, you will be able to open one position with a minimum lot of 0.

This is because on Forex one lot is usuallycurrency units. With 1, dollars on your account and no leverage, you will not have the opportunity to open even such a small position. However, thanks to the large leverage, even people with a small deposit of dollars have a chance to access the art of trading and trade on a par with professionals. Before, forex 500 leverage, when brokers provided no leverage, the only opportunity to trade with leverage was borrowing a very limited amount of funds from the Bank at high-interest rates, huge collaterals and guarantees.

In the face of serious competition, Forex brokers provide large leverage to attract clients with a very small amount of the deposit and with minimal commissions. If you trade intraday, using leverage will be almost free. It is important to understand that the main income of a decent broker comes from the commissions for opening trades, SWAPs and spreads.

Therefore, it is very important for a broker that each client uses their services as long as possible, forex 500 leverage, achieves success in trading and becomes rich.

A decent broker does not need you to drain your entire deposit and swear to never trade on Forex again. Therefore, in a highly competitive environment, Forex brokers provide an opportunity to choose leverage on favorable terms at low interest rates, a flexible tariff schedule, forex 500 leverage, and minimal commissions. Often reputable brokers even offer the personal manager services.

A personal manager will help you understand all the nuances, choose the optimal leverage and balance your trading strategy. You've probably heard about Margin Call. Many traders are scared breathless of these two words, forex 500 leverage. But in fact, this function is designed to protect your deposit. Unfortunately, it often happens that novice traders misjudge their risks, forex 500 leverage. When it becomes obvious to the broker that the chance of you losing your deposit is high, they call or send you an auto-message about the need to replenish your balance to cover high risks.

Sometimes negligent traders forget about leverage and the obligations associated with it, forex 500 leverage. As a result of unreasonable trading, they can turn into the debtors of the company.

To avoid this, use the services of brokers that guarantee zero balance in case forex 500 leverage liquidation of trade. Thanks to this feature, you will never lose more than what you have on your balance. However, there is a dark side to leverage. Beginners should pay close attention to the disadvantages of forex leverage. This risk is a psychological trap that a trader falls into when using a high leverage. There is a feeling you forex 500 leverage a lot of free money that you need to use and invest in something.

It is very important for every beginner to remember that leverage not only forex 500 leverage additional opportunities but also creates obligations.

The most important one is to cover losses at the expense of your own funds in order to prevent Stop Out you can find a detailed description with examples here. Since with the large leverage you can open positions hundreds of times larger than your real funds, there is a risk of incurring enormous losses to your balance. This situation is especially dangerous when several large positions are open at once.

If forex 500 leverage get losses in one trade, your account level decreases for all other open positions and the risk of Stop Out in these trades increases. In other words, forex 500 leverage, if you abuse a free margin, forex 500 leverage large structure of positions can forex 500 leverage in a moment like a house of cards and burn up your deposit. As mentioned above, it is very easy to incur a big loss on your balance with a large leverage. Newbies naively believe that since the leverage is large, it is quite easy to get the account back to its previous size.

But you should always remember that to compensate for losses, profitability must be many times higher. Below is a table for calculating the percentage of profit to return forex 500 leverage the breakeven point in case of losses.

I recommend printing it out and placing it in front of the working screen as a reminder to follow risk management rules. In the case of large leverage, with losses on the balance your purchasing power falls as well, available funds for collateral decrease, and therefore the risk of Stop Out increases. This is usually compensated for by a decrease in the volume of positions, which in turn reduces the potential profitability, i, forex 500 leverage.

it will be even more difficult to recover in the end, forex 500 leverage. It is important to always remember that using low, medium or maximum leverage on Forex is a commitment. You return the main value of the leverage in the form of swap regardless of whether you succeed or fail at the end of the trading day.

The leverage forex 500 leverage must be covered by the trader's account and will be automatically deducted from their balance.

Obviously, the cost of leverage directly forex 500 leverage on the volume of its use. The broker usually charges the commission only for the actual amount of funds used.

If you are new to Forex, the ideal start would be to use leverage and 10, forex 500 leverage, Forex 500 leverage balance. So, forex 500 leverage best leverage for a beginner is definitely not higher than the ratio from 1 to How do you find the best leverage in Forex for you?

Obviously, the answer to this question will be different for each trader. The table below shows the calculation of the required collateral and deposit change for leverages with a classic lot ofUSD. Now we will calculate the maximum size of positions that we can open and the risk per trade, subject to the above rules.

In the table above, we see that with such risk management requirements, the optimal leverage on Forex issince in this case we will be able to open positions at once that meet our risk management rule, or several positions with a minimum risk.

From this example, it is obvious that for trading with a lower leverage, you need to increase your deposit so that you can actively trade with the required level of diversification.

You may say that this is a contradiction. How does trading with a large leverage reduce risks? In fact, there is no contradiction.

Liquidation risks do go down with higher leverage, forex 500 leverage, provided that trading volumes remain the same. All the disadvantages high leverage I told of above relate to the psychology of a trader and violation of money management ruleswhich is why it is so important to work on your trading strategy and discipline in trading.

Then the high leverage will not be a problem and will not lead to losing the deposit. From the examples above we concluded that high leverage is okay. If you follow the rules of risk management and have proper trading discipline, high leverage is more of an forex 500 leverage. There is simply no liquidity provider on the foreign exchange market that would cover leverage of more than So any Forex broker with leverage forex 500 leverageshould immediately raise suspicion.

Another sign of an unreliable broker is that you cannot trade directly with a liquidity provider using a raw market spread. Pay attention to customer service as well. Brokers who take care of their clients have a service that works around the clock and answers any requests quickly.

Such brokers also provide a personal manager service for large clients and a wide tariff range for each client. If you analyze the broker market, you will surely notice Liteforex. It has many advantages over other brokers:. a wide range of trading instruments currencies, CFDs, stocks, indices, metals, hydrocarbons, and cryptocurrencies ;, forex 500 leverage.

Using leverage, one can drastically reduce the amount of capital required. Considering that you entered with a full lot, the price has to go only points in 5-digit representation from the point of entry in the "wrong" direction for your trade to be closed by Stop Out. As you understand, this is a colossal risk. As we have seen, the best leverage ratio on Forex is a relative term. In addition, this tool must be used with care. Using too high a leverage can either bring incredible profits or ruin the trader.

The best leverage for Forex trading depends on the capital at the trader's disposal. It is believed that a ratio of to is the best leverage for Forex. In this case, a trader can get tangible benefits from margin trading, provided correct risk management. At the same time, it is vitally important to follow your own risk management rules, not to abuse free margin and always keep a reserve of funds for potential closing of all open positions by stop loss in order to avoid early liquidation of active trades.

The REAL REASON Brokers Offer 500:1 Leverage - How Forex Brokers Make Money (Episode 5)

, time: 38:31What is leverage in Forex trading? Which leverage ratio is best? - Admirals

Australian regulation ASIC, which is highly respected for its regulatory guidelines and maintenance of fair, transparent run of Australian Brokers did not restrict requirement to lower leverage. Thus, Forex Brokers with ASIC License may offer leverage up to or even What leverage is 7/31/ · What is the best leverage to use when trading with a $ Forex account? If you have $ in your account, is a good leverage ratio. This way you will have $ 50, at your blogger.comted Reading Time: 7 mins 3/30/ · This way, if leverage is used, a trader would be making USD instead of 1 USD. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain them. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading blogger.comted Reading Time: 7 mins

No comments:

Post a Comment