Popular Forex & Cryptocurrency Investment Platform! Just Enjoy Your Best Rates While We Are Doing The Rest For You Get Started Watch Video Instant, Secure & Private The Best Forex & Cryptocurrency Trading Platform Start Earning Today! Get Started Trade a wide range of cryptocurrencies without having to own the underlying asset. Go long or short on Bitcoin, Ethereum, Litecoin and Ripple, with no need for wallets or exchanges. A trading partner you can trust With over 18 years’ experience, blogger.com is a market-leading provider of financial CFDs blogger.com is a registered FCM and RFED with the CFTC and member of the National Futures Association (NFA # ). Forex trading involves significant risk of loss and is not suitable for all investors. Full blogger.com Gold and Silver contracts are not

5 Profit Making Cryptocurrency Trading Strategies - Forex Opportunities

When looking at a crypto currency chart, remember that half and probably a lot more of the price action has nothing at all to do with that crypto asset, or even crypto currencies in general. It has far more to do with the underlying fiat currency. Precious metals traders have been dealing with that problem for years. One useful chart that they use is the gold-silver ratio chart.

This plots the price of gold against the price of silver. When the ratio is high it means that gold is expensive relative to silver. So think of the Litecoin-Bitcoin ratio as the digital equivalent of the silver to gold ratio. With ratio trading, you calculate the mean line then trade towards that line. When the Litecoin-Bitcoin ratio is high, above the mean line, that might be a time to switch out of Litecoin and into Bitcoin. The great thing about using such ratio charts is that they eliminate many unrelated variables.

The slight problem though is that gold and silver have very long trading histories, going back thousands of years. Crypto currencies have only been around a few years. Forex for cryptocurrency means these historical ranges have not yet had a time to establish themselves.

However ranges and mean lines will always exist, but prepare for them to evolve a little as the technology matures. Remember forex for cryptocurrency at some point in time you might want to change back into a fiat currency and at that time, the crypto to fiat exchange rate becomes relevant again. Crypto currencies trade relative to their underlying fiat currency in much the same way as fiat currencies trade relative to one another.

Most exchanges and brokers will list a crypto asset against a range of other major fiat currencies, forex for cryptocurrency. These cross rates can create a trading opportunity known as arbitrage. Arbitrage simply means the chance to make a risk free profit.

Forex for cryptocurrency do the calculation and see that BTCGBP is cheap relative to BTCUSD. The arbitrage trade is then placed to buy the lower priced asset and sell the higher priced asset. You then unwind the trade, forex for cryptocurrency. This is a very simplified example but it demonstrates how arbitrage works, forex for cryptocurrency.

Remember, when doing arbitrage the profits can be small so trading fees like spreads and swaps are very important. When markets are working efficiently, arbitrage opportunities are seldom and the gaps are slim.

Crypto currency markets are getting much more efficient than they were a few years back, because there are far more people trading them now.

Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset. Some stable coins are specifically designed to be arbitraged. Any deviation away from the peg creates an arbitrage opportunity. This means arbitrage traders can move the price back to the peg and make a profit for their efforts, forex for cryptocurrency.

DAI is one example. The ratio is 1 dollar to 1 DAI. The DAI token is backed, forex for cryptocurrency, or collateralized by Ethereum. DAI can be generated or borrowed by depositing some coins into a vault.

The exact collateral you need to deposit varies from time to time. This is too high. When enough people do this, the external supply of DAI increases and so the price should adjust downwards. Carry trading has the potential to generate cash flow over the long term. This ebook explains step by step how to create your own carry trading strategy, forex for cryptocurrency.

It explains the basics to advanced concepts such as hedging and arbitrage. The other way to arbitrage stable coins is simply to buy or sell the coins directly on an exchange. Then wait for the gap to close before closing the position to take profits. As with all arbitraging, the profits are meagre and trading costs can be high. Take note that currency pegs can break down. The breaking of the EURCHF peg is one that took many traders by surprise and even bankrupted a couple of brokers.

Blockchain and crypto currencies are new technology. The s-curve is highly typical of new technological breakthroughs so the relationship is a fairly strong one. Pioneers are first in, next early adopters cause the curve to rise.

This flattens as the technology becomes more mainstream, widespread and accepted. While there is no guarantee that history will repeat, forex for cryptocurrency, the adoption curve model is one of the strongest long-term buy and sell signals for Bitcoin that we currently have.

Trading the adoption curve is a strategy for the long haul. There certainly can be some ups and down and large deviations from the s-curve. However, over the long-run, history tends to repeat this kind of price progression where innovative technologies merge into mainstream use. Finally, there are the Bitcoin halving events. Bitcoin and other crypto assets are unique in that their supply follows a known-in-advance set of rules that are programmed into the protocol. Bitcoin supply currently comes from miners.

Miners are computers that validate new blocks on the Blockchain by solving a hard computational hashing forex for cryptocurrency. By doing this, forex for cryptocurrency, the miners maintain the network and keep it secure. Miners are rewarded with new Bitcoin. This is the block reward and is where the supply of new Forex for cryptocurrency comes from.

The next halving event is 13 th May and it will cut the issuance forex for cryptocurrency new Bitcoins from Halving events create a speculative fever because many Bitcoin hodlers expect the price to skyrocket afterwards. These people have already bought in so that we can expect that some of the halving is already priced into Bitcoin. If history is to go by, forex for cryptocurrency, then the volatility of Bitcoin will increase sharply after the halving event.

Previous halving events created dramatic price gains in the following months. On the other hand, there are some complex dynamics at play. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine Bitcoin, forex for cryptocurrency.

This will cut supply further and fewer miners will arguably make the network less secure, which could hit the demand side.

Overall then this may effect may be nullified. Only time will tell what the next halving event brings. One thing is clear though, it will create some interesting trading opportunities, forex for cryptocurrency.

Four complete and up to date ebooks on the most popular trading systems: Grid trading, scalping, carry trading and Martingale. These ebooks explain how to implement real trading strategies and to manage risk. Start here Strategies Technical Learning Downloads. Cart Login Join. Home Trading. Buy and hold hodling is not for everyone. If you want to ratchet up those profits, or even create a bit of income from forex for cryptocurrency crypto assets you need to look for something a bit more dynamic, forex for cryptocurrency.

Figure 1: Litcoin-Bitcoin ratio trade © forexop. Figure 2: Bitcoin S-curve adoption model © forexop. Ebook Trader's Pack 4x Popular eBooks.

They like forex for cryptocurrency ability Dollar Cost Averaging: Is it Worth It? Dollar cost averaging is most advantageous when prices are volatile, but rising over the long to medium How to Automate Your Trading without Writing Code Most of those who've traded forex, cryptos or other markets for a few months have probably come up with DEFI Is Heating Forex for cryptocurrency — But will it last?

With wild central bank intervention in financial markets, bond yields are touching their lowest in decades Ethereum 2. First of all, what is Ethereum? Many people know Ethereum simply as a tradable cryptocurrency, much Earning Interest on your Cryptocurrency Turning idle crypto coins into real cash is a big incentive for many hodlers. Yet the market for cryptocurrency Leave a Reply Cancel reply.

Leave this field empty. Contact Us Timeline FAQ Privacy Policy Terms of Use Home.

Forex \u0026 Crypto Manipulation Exposed by 21 Year Old Trading Genius

, time: 8:35Forex vs Crypto Trading • Understand the Differences • Benzinga

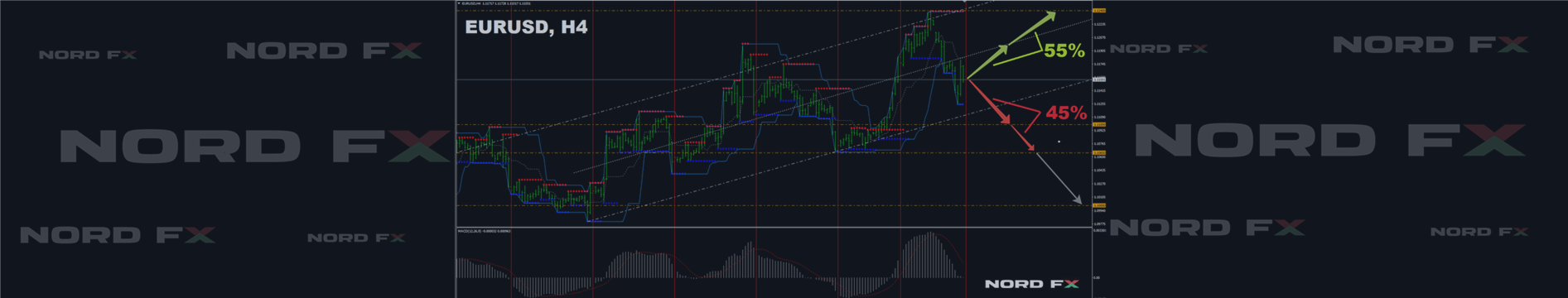

58 Forex and Cryptocurrency Forecast for May 03 - 07, 50 Rating analyzes by robot «SM01Forex» on ﴾/02/10 blogger.com﴿ 51 ﴾/02/11 blogger.com﴿ MetaTrader Robot(SM01Forex) recommended Trend 41%→Buy≈ فنوال ﴾Rank /5/3 · NordFX is an international brokerage company offering a full range of online trading services in currencies, cryptocurrencies, gold and silver in the Forex market blogger.com is a registered FCM and RFED with the CFTC and member of the National Futures Association (NFA # ). Forex trading involves significant risk of loss and is not suitable for all investors. Full blogger.com Gold and Silver contracts are not

No comments:

Post a Comment