There are four shifters in the FOREX market that will affect the supply/demand of a nation's currency. #1 = Tastes and Preferences. #2 = Relative Income Levels (recession in one country, that country's income will fall). #3 = Relative Inflation Rates (changes in Price Level). # 4 = Relative Interest Rates ap macroeconomics changes in the foreign exchange market & net exports AGENDA Lesson Overview Background Knowledge The New New Guided Practice LESSON OVERVIEW • Learning Objective: Explain (using graphs as appropriate) how changes in the value of a currency can lead to changes in a country’s net exports and aggregate demand I can Aggregate Supply and Aggregate Demand (The AS/AD Model) •LRAS is equal to the full employment level of output. •In the long run the economy will always return to LRAS. •In the short run the economy can have an inflationary gap (output above LRAS) or a recessionary gap (output below LRAS) •AD is equal to GDP and C+Ig+G+Xn

6 Key Macroeconomics Graphs - AP/IB/College - blogger.com

AP, IB, and College Microeconomic and Macroeconomic Principles. New YouTube Channel! Like and Subscribe! But there are some differences you need to be aware of, forex graph ap macro. Review it all below; then check your understanding forex graph ap macro the Flash game below. Note: I will use the market US Dollars relative to Mexican Pesos as my example for simplicity, but these concepts apply equally to any two currencies.

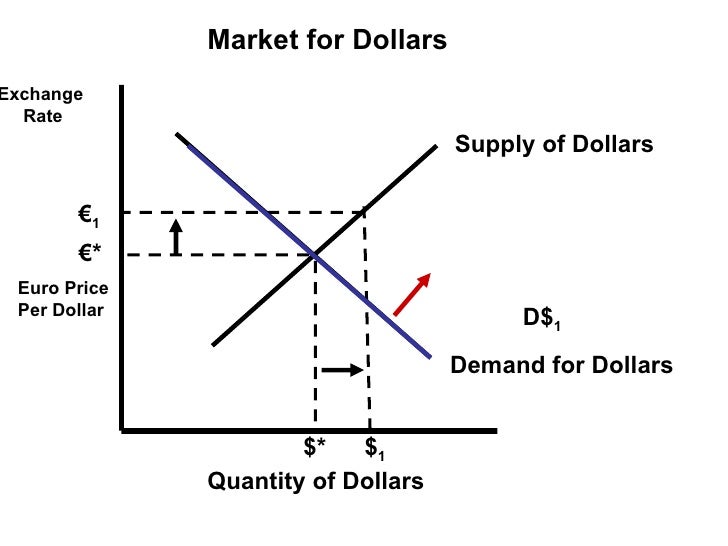

Just like every other market, where the two curves intersect you find the equilibrium price and equilibrium quantity. In this case, the price is called the exchange rate. When the exchange rate increases,the currency appreciates. When the exchange rate falls, the currency depreciates. Determinants of Currency Demand : There are 3 determinants of demand for a currency shifters. If demand for exports decrease, demand for the currency also decreases causing the currency to depreciate.

The second determinant of demand is interest rates. These interest rate changes could come from the loanable funds market or the money market. If the US interest rate increases relative to Mexico, the demand for US dollars will increase as foreign investors purchase dollars to invest in the US seeking a higher rate of return.

At the same time the demand of Mexican Pesos in the market for pesos will decrease as foreign investors will demand fewer pesos to invest in Mexico. This will cause the US dollar to appreciate while the Mexican Peso depreciates. The third determinant of demand is the expected future exchange rates.

Higher future exchange rates increase demand and lower expected future exchange forex graph ap macro decrease demand. Determinants of Currency Supply: There are 3 determinants of supply for a currency shifters, forex graph ap macro.

The first is the demand for imports within the country. When a country demands more imports, importers sell dollars to purchase the foreign currency needed to pay for the imports. Higher US demand for imports means a higher supply of US Dollars in the foreign exchange markets. The second determinant of supply is interest rates. These interest rate changes could come from the loanble funds market or the money market. This will increase the supply of US dollars.

It will also decrease the supply of Mexican Pesos as people with Pesos will be less likely to sell them given the higher interest rates in Mexico. The third determinant of supply is the expected future exchange rate.

Higher expected future exchange rates decrease supply and lower expected future exchange rates increase supply. When the US dollar depreciates, US exports get cheaper for foreign entities and imports get more expensive. As a result, a weak dollar increases net exports and strong dollar decreases net exports. Special Notes about the foreign exchange markets : Currencies are closely linked in the foreign exchange markets.

Every time someone exchanges dollars for pesos, they have simultaneously increased the supply of dollars and the demand for pesos. And every time someone exchanges pesos for dollars, they simultaneously increase the supply of pesos and the demand for dollars. When it comes to currencies one cannot be demanded without the other being supplied. As a result, when the US Dollar appreciates relative to the Mexican Peso, the Mexican Peso depreciates relative to the US Dollar and vice versa. Also, since the determinants for both curves are so similar, when the demand for a currency increases, the supply for that same currency generally decreases.

Likewise when the demand for a currency decreases, the forex graph ap macro for that currency generally increases. These double shifts amplify the change in the exchange rate while making the equilibrium quantity indeterminate. This aspect can get a little complicated and the College Board has isolated shifts in the past. As a result, the game below only focuses on one shift at a time. Up Next: Review Game: Foreign Exchange Market Review Activity Graph Drawing Practice: Foreign Exchange Markets Content Review Page: Comparative Advantage.

IB is a registered trade mark of International Baccalaureate Organization which was also not involved in the production of and does not endorse this material.

I would like to forex graph ap macro the work of Dick Brunelle and Steven Reff from Reffonomics. I would also like to thank Francis McMann, James Chasey, and Steven Reff who taught me how to be an effective AP Economics teacher at AP summer institutes; as well as the countless high school teachers, and college professors from the AP readings, economics facebook groups, forex graph ap macro econtwitter, forex graph ap macro.

Youtube Facebook-f Twitter. Total Review Micro Guides AP Micro CED Alignment Micro Study Guide Micro Graphs Micro Formulas Micro Math Video Basic Concepts What Is Econ?

Unit 3 Video Imperfect Competition Monopoly Oligopoly Mono Comp. Outside Resources, forex graph ap macro. Privacy Policy. Contact Me. Copyright © — Jacob Reed.

Supply and demand curves in foreign exchange - AP Macroeconomics - Khan Academy

, time: 6:49The foreign exchange market model (article) | Khan Academy

DISCLOSURE: We get commissions for Registrations/Purchases made through affiliate links in this website (blogger.com). Trading Forex, Ap Macro Forex Binary Options - high level of risk. Please remember these are volatile instruments and there is a high risk of losing your initial investment on each individual transaction ap macroeconomics changes in the foreign exchange market & net exports AGENDA Lesson Overview Background Knowledge The New New Guided Practice LESSON OVERVIEW • Learning Objective: Explain (using graphs as appropriate) how changes in the value of a currency can lead to changes in a country’s net exports and aggregate demand I can Foreign Exchange Graphs are just supply and demand markets for a particular currency, but they can be tricky. So make sure you read this review before your next AP, IB, or College Macroeconomics Exam

No comments:

Post a Comment