/07/31 · July 31, July 31, The Forex Geek. The Inside Bar is a two candles pattern representing price continuation/reversal. Its formation takes place when the second candle is inside the preceding candle, hence the name inside bar. Contents show /11/11 · Last Thoughts on the Inside Bar Forex Strategy. The inside bar as an entry signal does not offer the trader an edge over the market in most scenarios, however the inside bar used for reading the price action story can be very useful. It is important to understand why the market moves like it does /09/02 · The following steps are used when identifying the inside bar pattern on forex charts: Identify a preceding trend using price action / technical indicators Locate inside bar pattern whereby the inside bar is engulfed fully by the preceding candle high and low

Inside bar price action Pattern Definition. How to trade?

Its relative position can be at the top, the middle or the bottom of the prior bar. Some traders use a more lenient definition of an inside bar that allows for the highs of the inside bar and the mother bar to be equal, or for the lows of both bars to be equal.

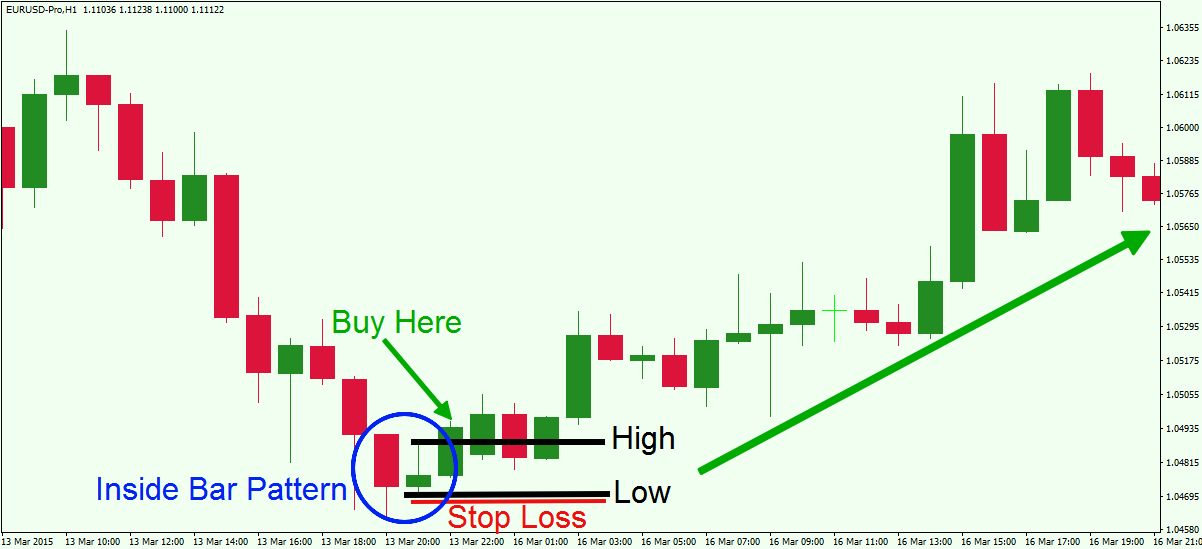

Inside bars show a period of consolidation in a market. However, they can also form at market turning points and act as reversal signals from key support or resistance levels. The classic entry for an inside bar signal is to place a buy stop or sell stop at the high or low of the mother bar, forex inside bar, and then when price breakouts above or below the mother bar, your entry order is filled.

In the example below, we can see what it looks like to trade an inside bar pattern in-line with a trending market.

Note, often in strong trends like the one in the example below, forex inside bar, you will see multiple inside bar patterns forming, providing you with multiple high-probability entries into the trend:. In the example below, we are looking at trading forex inside bar inside bar pattern against the dominant daily chart trend.

In this case, price had come back down to test a key support levelforex inside bar, formed a pin bar reversal at that support, followed by an inside bar reversal. Note the strong push higher that unfolded following this inside bar setup. In this case, we were trading an inside bar reversal signal from a key level of resistance, forex inside bar.

Also, note that the inside bar sell signal in the example below actually had two bars within the same mother bar, this is perfectly fine and is something you will see sometimes on the charts. Trading inside bars from key levels of support or resistance can be very lucrative as they often lead to large moves in the opposite direction, as we can see in the chart below….

For more forex inside bar on trading inside bars and other price action patterns, click here. Note, often in strong trends like the one in the example below, forex inside bar, you will see multiple inside bar patterns forming, providing you with multiple high-probability entries into the trend: Trading Inside Bars against the Trend, forex inside bar, From Key Chart Levels In the example below, we are looking at trading an inside bar pattern against the dominant daily chart trend.

Inside bars at key levels as reversal plays are a bit trickier and take more time and experience to become proficient at. Inside bars work best on the daily chart time frame, primarily because on lower time frames there are just too many inside bars and many of them are meaningless and lead to false breaks. Practice identifying inside bars on your charts before you try trading them live.

Your first inside bar trade should be on the daily chart and in a trending market. Inside bars sometimes form following pin bar patterns and they are also part of the fakey pattern inside bar false-break pattern forex inside bar, so they are an important price action pattern to understand, forex inside bar.

Inside bars typically offer good risk reward ratios because they often provide a tight stop loss placement and lead to a strong breakout as price breaks up or down from the pattern. Price Action Strategies Support and Resistance Levels Trading Strategy What is support and resistance? Support and resistance levels are horizontal price levels that typically connect price bar highs to other price forex inside bar highs or low Continue Reading, forex inside bar.

Pin Bar and Inside Bar Combo Trading Strategy Pin bar and Inside bar Combo Patterns A pin bar is a price action strategy that shows rejection of price and indicates a potential reversal is imminent. An insi The Fakey patter Inside Bar Trading Strategy The Inside Bar Pattern Break Out or Reversal Pattern An "inside bar" pattern is a two-bar Continue Reading.

Pin Bar Trading Strategy The Pin Bar Pattern Reversal or Continuation A pin bar pattern consists of one price bar, typically a candlestick price bar, which represents a sharp reversal Education Price Action Trading University Price Action Trading Strategies Nial Fuller — Professional Trader What Is Price Action? Price Action — Home Contact. Recent Forex inside bar Price Action Trading Video Tutorials Why Price Action Leads The News Why Price Action Strategies Will Simplify Your Trading The Simplest Trading Strategy in the World What Is The Best Price Action Trading Strategy?

Categories Price Action Trading Articles Price Action Trading Videos.

How to Trade Inside Bars - Inside Bar Breakout Strategy - Day Trading ✅

, time: 7:14What Is The Inside Bar Candlestick Pattern & How To Trade With It | Honest Forex Reviews

/09/02 · The following steps are used when identifying the inside bar pattern on forex charts: Identify a preceding trend using price action / technical indicators Locate inside bar pattern whereby the inside bar is engulfed fully by the preceding candle high and low /04/08 · The inside bar can be an extremely effective Forex price action strategy. However, the effectiveness of the inside bar strategy is largely based on the price action surrounding it. In other words, an inside bar alone does not constitute a valid trade setup. Far from it /10/13 · An inside bar is formed when price trades within the high and low range of the previous day, making the candle an inside day or an inside bar. The inside bar is therefore a two candlestick price pattern. An inside bar is also similar to a bullish or a bearish harami candlestick pattern.4,4/5(36)

No comments:

Post a Comment