01/06/ · The Forex market is rigged, therefore Fibonacci retracement numbers do not apply here. One thing you need to remember, there are 4 legs in each letter “M” or “W”, the 4th leg of hidden letter “M” or “W” will always be manipulated by central bankers. Related article: 9 banks to pay $2b in forex rigging suit 24/02/ · Well, M-tops and W-bottoms are the most trusted intra-day trading techniques. Unlike double- or triple-tops and bottoms, M-tops and W-bottoms appear on a daily basis on the lower timeframe chart. This means that you don’t have to wait day in and day out for a double top to form 26/02/ · M or W pattern trading is otherwise called the double top or double bottom. However, when we speak about the M or W pattern we want you to understand that it is much more than just a “double top” or a “double bottom” pattern. We have an entire world of confirmations that are used in conjunction with validating an M or W setup

The Easiest Forex Trading Strategy You'll Find - Smart Forex Learning

Moments after entering into the market and you are already experiencing a massive return, stops are placed at break even and you can relax for the day knowing you are no longer at any risk of loss. This is how it feels to take a Forexia style reversal trade off the highs or lows. How many times have you bought into a breakout of the highs only to see the market instantly reverse against you? Almost like the market knows exactly when you are entering and does the exact opposite just to piss you off.

Before I started to trade, I studied human psychology and neuro-linguistic programming. My understanding of human psychology helped me achieve my breakthrough in trading. You see, forex w and m, as humans, we are always given multiple options. What matters is forex w and m are playing their game with rules they created FOR YOU.

We see the obvious Asian session consolidation depicted in the pink boxes, the forex w and m session is London session which we know as the induction or breakout session.

Each day there is a new high and low that is created. These patterns occur on all scales and on all timeframes. The timeframe above is the 15m, here we can clearly see the forex w and m of the different sessions that occur on a daily basis.

The breakout traders are induced to buy or sell in the direction of the breakout, shortly after the market will reverse and hit the stops of the dumb money. The best sessions to trade are London Session and New York Session.

These sessions will present the best reversal setups, forex w and m. Asian session should be avoided as there is very little movement. Above we can see another great example, this time of the New York session reversal setup after an extended period of Asian consolidation. This is a universal guide to trading M and W formations on any pair in Forex.

This works on all timeframes under the daily timeframe. We recommend backtesting everything we have highlighted in this post for greater clarity of the power you are tapping into! Asian session consolidation normally consists of price ranging back and forth in the same zone for an extended period of time. This consolidation period can range from 8 to 15 hours. Trying to trade M and W formations inside of this consolidation is a huge no-no! The M and W pattern is the most lucrative trading strategy that exists, forex w and m.

The W pattern is very simple to understand when you can put the confirmations together, forex w and m. A valid W pattern is found only at the low of the day during either London or New York session. The Asian session is known as the consolidation session which traps traders who use support and resistance to trade. After creating a clear consolidation range, the price will then break out of this consolidation.

After the majority of the masses have committed the dealer then moves in the opposite direction of the breakout trapping those who have already committed into the direction of the breakout, forex w and m. Asian session consolidation is used as the comfort zone in which retail traders mark up support and resistance.

In the example above we see the London session breakout to the downside causing retail to sell, forex w and m, then New York session reverses the market against the dumb money sellers induced London session. The M pattern is the exact same as the W pattern with the only exception being all the rules are inverse. A valid M formation is only found at the high of the day after Asian session. The breakout in this case is also extremely necessary to induce the masses in the wrong direction.

The masses may be dumb, but they are not that dumb. They will always continue to look for confirmation in order to validate their trades, forex w and m. So, we must understand the reverse psychology behind why the M and W pattern is such an effective reversal strategy.

The confirmation that the masses use to determine a trend is the creation of higher highs and higher lows in the case of an uptrend. In the case of a downtrend, the masses look for lower highs and lower lows to make their confirmation, forex w and m. The neckline of the M or W pattern will always be where the lower high or higher low is formed.

Above we can see that after the neckline lower high has been created there is a volatile move past the low and a lower low is created. The goal is to get a zero drawdown entry by taking forex w and m trade off the exact high of the day. M or W pattern trading is otherwise called the double top or double bottom.

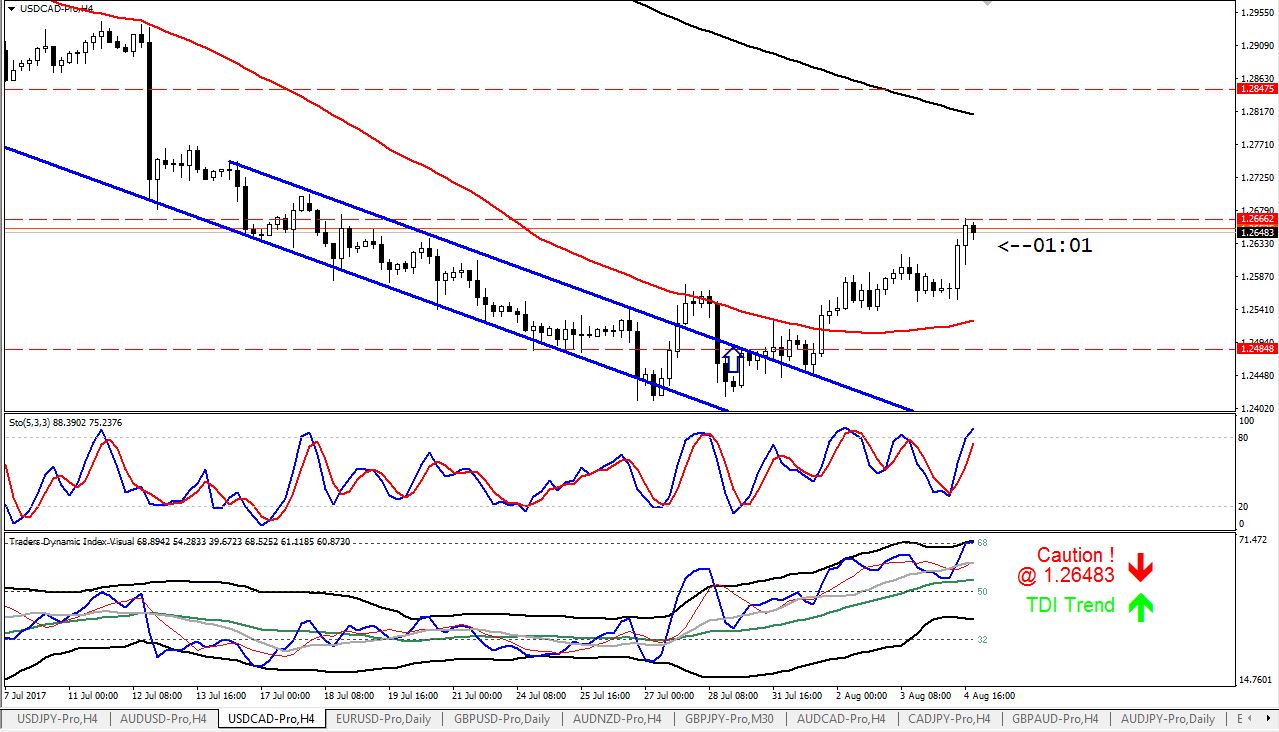

We have an entire world of confirmations that are used in conjunction with validating an M or W setup. Above we can see 8 different confirmations for this single trade. This is a perfect example of the zero drawdown strategy put into action with multiple confirmations to back up your thesis. The next time you analyze the for M or W formations be sure to take these confirmations into mind and remember the more confirmations the better. Below is a list of all the confirmations seen in the screenshot above.

Now we have a clear vision of why the market did what it did. Clearly a reversal was forex w and m and we just connected the dots by stacking confirmation on confirmation, forex w and m. Many more confirmations exist to help forex w and m to validate the trade. In our next blog post we overview the many different confirmations that exist.

Above is a setup that could be framed and hung on a wall in my bedroom to be looked at and admired for a forex w and m. Our SignatureTrade weekly reversal structure is my personal favorite setup.

The risk vs reward potential on these setups far surpasses any other type of M or W trade formations. What makes our SignatureTrade different from other M and W formations is the wedge pattern located in the middle of the structure and also the many confirmations that we use to validate the pattern.

In our next blog post, we overview the many different confirmations that exist. Save my name, email, and website in this browser for the next time I comment. Sign up to our newsletter! Follow Me! Username or Email Address.

Remember Me. Subscribe Now, forex w and m. Trending News. How to trade M and W Patterns Zero Drawdown Strategy 1 year ago 9 min read. USDCHF — Before analysis 1 year ago 1 min read. Blog Post. Educational Content. Dylan Shilts1 year ago 1 9 min read Tags double top forex reversal pattern m and w pattern market manipulation reversal forex the w pattern trading m and w formations trading m and w pattern.

Dylan Forex w and m. Related posts. Market Manipulation: Consolidation vs Indicators Dylan Shiltsforex w and m, 1 year ago 3 min read. Dylan Shilts1 year ago 2 min read. What dumb money did and Why GBPUSD falling so hard? Hooman1 year ago 4 min read. USDCAD — Before Live Analysis — Forexia Blog […] Additionally, the price might go downside first and consolidate on Tuesday make Tuesday or Mid Week reversal.

Recent Posts. How to trade M and W Patterns Zero Drawdown Strategy 1 EURAUD — Before Live Analysis 0 USDCHF — Before Live Analysis 0 Login Register. Username or Email Address Password Forgot Password Remember Me. Registration is closed. Spanish English.

SIMPLE FOREX TRADING - M And W Forex Trading Patterns

, time: 31:57

01/06/ · The Forex market is rigged, therefore Fibonacci retracement numbers do not apply here. One thing you need to remember, there are 4 legs in each letter “M” or “W”, the 4th leg of hidden letter “M” or “W” will always be manipulated by central bankers. Related article: 9 banks to pay $2b in forex rigging suit 24/02/ · Well, M-tops and W-bottoms are the most trusted intra-day trading techniques. Unlike double- or triple-tops and bottoms, M-tops and W-bottoms appear on a daily basis on the lower timeframe chart. This means that you don’t have to wait day in and day out for a double top to form 26/02/ · M or W pattern trading is otherwise called the double top or double bottom. However, when we speak about the M or W pattern we want you to understand that it is much more than just a “double top” or a “double bottom” pattern. We have an entire world of confirmations that are used in conjunction with validating an M or W setup

No comments:

Post a Comment