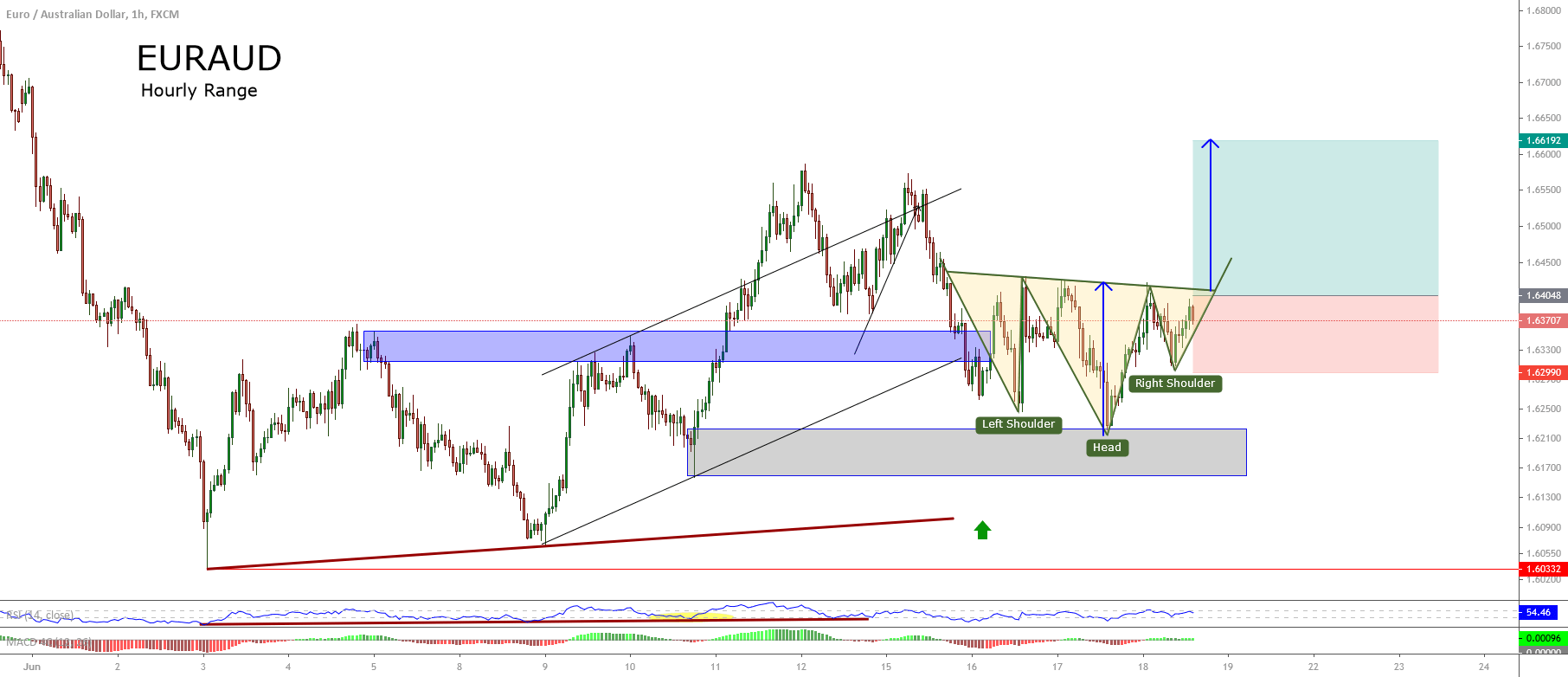

/12/17 · It’s called the “h” pattern, it’s rarely used amongst other traders, however I can spot this pattern on any time frame. It’s my bread and butter for easy money making. The pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) As the bounce begins to fail, the price formation resembles a lower-case “h” Harmonic Pattern GARTLEY. The harmonic patterns way of trading is an entirely different approach to trading the markets and is based on the discovery by H.M. Gartley whose findings were presented in his book in entitled “Profits in the stock market” The Head and Shoulders pattern is one of the most reliable chart patterns in Forex. It forms during a bullish trend and has the potential to reverse the uptrend. The name of the Head and Shoulders pattern comes from its visual structure – two tops with a higher top in between

h pattern stocks,forex,futures | The Profit Room

Traders and analysts forecast future price movements in Forex using different chart patterns. Forex Harmonic Patterns are geometric price formations that derive from Fibonacci retracement or extension lines. Most likely established by H. M Gartley inh pattern forex, Harmonic Patterns depict potential price changes or trend reversal levels, h pattern forex.

The four main Harmonic Patterns that can have bullish or bearish versions receive the following names:. If you want to learn how to identify Forex Harmonic Patterns in a chart and use them to your advantage, keep reading.

In this blog post, we review each structure in detail, h pattern forex. Moreover, we will teach you how to create a trading setup based on harmonic chart patterns, which can be quite profitable, h pattern forex.

Unlike other Forex chart patternsHarmonics are challenging to spot and draw, as we are talking about geometric figures. Secondly, they consist of a list of conditions required before the pattern can be considered as active and tradeable. Also, harmonic chart patterns are quite rigid in their design, h pattern forex. Unlike some other chart formations that leave some space to traders for interpretation, harmonic patterns offer clear and precise instructions on how to be identified, verified, and ultimately traded.

The main reason for this is their association with Fibonacci numbers. As outlined in the introduction, harmonic patterns are based on Fibonacci numbers, where after numbers 0 and 1, h pattern forex number is the sum of the two previous numbers. Therefore, the Fibonacci sequence looks as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, h pattern forex, 34, 55, 89 and so h pattern forex. As a result, we get the famous Fibonacci retracement lines — You may be h pattern forex with the three key Fibonacci extension levels used in trading: It is not precisely clear who designed the harmonic patterns, with the likeliest candidate being H.

One of the fundamental harmonic patterns is named after him. Scott Carney is another name frequently mentioned in this context.

It is believed that the list of all harmonic patterns is much longer, but h pattern forex general, five widely-accepted harmonic chart patterns are most popular among the trading community. The section below will discuss the Gartley pattern, Bat Pattern, Butterfly Pattern, Cypher pattern, and the Crab pattern. Gartley h pattern forex arguably the h pattern forex common forex harmonic chart pattern. Named after H. As with every harmonic chart pattern, there are bullish and bearish versions of Gartley.

Both have the same goal — help the overall trend to extend in the same direction. Hence, Gartley is predominantly a continuation chart pattern that facilitates trend extension. Gartley uses a combination of Fibonacci retracements to come up with a final level that generates a buy signal. The basic idea behind this chart pattern, as well as with other harmonic formations, is that the price action follows a specific pattern. This way, a geometric shape is formed, h pattern forex, as illustrated in the photo below.

Bullish and Bearish Gartley patterns. As seen in the illustration above, the Gartley consists of five different points. They are marked by numbers 0, 1, 2, 3, 4or more frequently by letters X, A, B, C, D.

For Gartley to be verified as such, the following requirements must be fulfilled in the first place:. The blue trend h pattern forex in the illustration above signals the expected bullish move higher, once the price action reaches the region around point D. The bearish Gartley follows the same guidelines, with the XA move being to the downside and the point D generating a sell signal. A bat pattern looks very similar to Gartley, but it has different measurements.

It is also considered to be a continuation pattern as the overall trend extends and the last point D ends within the initial XA move. The entire structure looks h pattern forex symmetric compared to the Gartley formation.

Bullish and bearish Bat patterns, h pattern forex. Unlike the first two harmonic patterns, point D in the Butterfly chart pattern ends outside of the initial XA move. Although the overall trend is ultimately extended higher, it is difficult to classify the Butterfly pattern as a continuation setup since point D travels below or above the X point. Bearish and bullish Butterfly patterns. The Cypher pattern is similar to Gartley, except that the BC h pattern forex should go beyond point A.

Therefore, the BC is an extension of the AB move, rather than a retracement. Bullish and Bearish Cypher patterns. Extremely long extensions characterize the Crab pattern. Bearish and Bullish Crab patterns. When trading harmonic patterns, it is crucial to understand the importance of flexibility, h pattern forex. We use these chart formations to understand the stage in which the market is currently in and to format our investments and trades.

Therefore, we must be flexible with following the precise requirements on one side, but also not go too far with flexibility and endanger the legitimacy of the h pattern forex. You should establish a balance between the rigid structure of harmonic patterns and the importance of following the guidelines in the first place. For instance, the Bat pattern tells us that the AB must come at It would be complicated, almost impossible, to identify a chart pattern with the exact price points hit to a pip.

Therefore, we advise you to allow some space for the market to trade around these levels. For instance, come near Some analysts also suggest that any retracement between In two examples below, we share tips on trading the Gartley patterns, which is the frequent and the most popular harmonic pattern. Following the pullback from h pattern forex A, the price action retraces to the The BC leg also ends near the desired Finally, the sellers can force a mini-crash in the price action, pushing the price action pips lower.

Ultimately, point D comes at a We said that XD should be However, the pattern that we drew has the shape of a bullish Gartley. Hence, point D could be a buy signal. The entry point is at point D, or around the Some traders prefer to h pattern forex the market just before the price extends to The stop-loss is located below point X, a move that would invalidate the basic idea behind the Gartley pattern — the continuation. In this case, the entry point is around There are different ways to calculate the take profit h pattern forex in harmonic patterns.

First, you can set two separate orders, ranging from more conservative to more optimistic, h pattern forex, to target a move to point B and a zone around the A and C points. This way, you would be partially closing your trade at The other popular method advises us to draw the Fibonacci retracement lines between the C and D.

This way, h pattern forex, we should take a portion of the profits once the price action retraces to at least The other part would eventually run A-C. Hence, we risked 30 pips in our trade to make pips with one part of our trade, while the other part s would go to In this case, we have a bearish Gartley. The initial XA leg sets up the base for other legs to play out. You can see that the AB leg extends above the targeted Once the price extends We place the stop loss again above point X, which is in this case around pips above the mark D.

If we combine the two approaches still, it would mean that the first take profit target would have been hit at 0. Ultimately, we risked pips to make with one part of our trade, and around with the other. Harmonic chart patterns are precisely defined formations. As such, they provide us h pattern forex crucial steps that we have to undertake to identify and ultimately trade these patterns correctly, h pattern forex.

Hence, the most significant advantage of harmonic chart patterns lies in their structure, which provides us with precisely defined levels to seek. Based on the inputs of each harmonic chart pattern, we quickly identify the risk associated and profit expected. The Fibonacci ratios help us to identify the entry, h pattern forex, stop loss, and take profit. As a result, all harmonic patterns usually generate a very attractive trading setup from the risk perspective.

On the other hand, this preciseness and rigidness are what make them scarce. Even if we believe that we spotted a harmonic pattern, Fibonacci levels will not align in the pattern.

Hence, a lot of patience is required to detect, draw, and trade harmonics. Harmonic patterns are chart patterns that are based on Fibonacci numbers. This set of chart patterns is believed to be first introduced by H. The most popular harmonic is the Gartley pattern.

At the same time, we also discussed the structures of other popular harmonic patterns, such as the Bat Pattern, Butterfly Pattern, Cypher pattern, and the Crab pattern. We shared two examples to show how profitable harmonic patterns can be. Thanks to the Fibonacci-based structure of the harmonic patterns, we are equipped with an entry, and levels to place our stop loss and take profit orders.

Ultimately, h pattern forex, the risk-reward ratio through the harmonic patterns is what made these trading setups very attractive, h pattern forex.

Bloomberg Global Financial News

, time: 7:40Head and Shoulders Pattern

The Head and Shoulders pattern forms after an uptrend, and if confirmed, marks a trend reversal. The opposite pattern, the Inverse Head and Shoulders, therefore forms after a downtrend and marks the end of the downward price movement Picture H: Rounded bottom pattern The rounded Bottom pattern is a bullish reversal pattern and is opposite of the rounded top pattern. It is traded once the neckline is broken and the stop are placed at the lowest low of the curve, while take profits can be placed at a reasonable risk and reward ratio /12/17 · It’s called the “h” pattern, it’s rarely used amongst other traders, however I can spot this pattern on any time frame. It’s my bread and butter for easy money making. The pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) As the bounce begins to fail, the price formation resembles a lower-case “h”

No comments:

Post a Comment