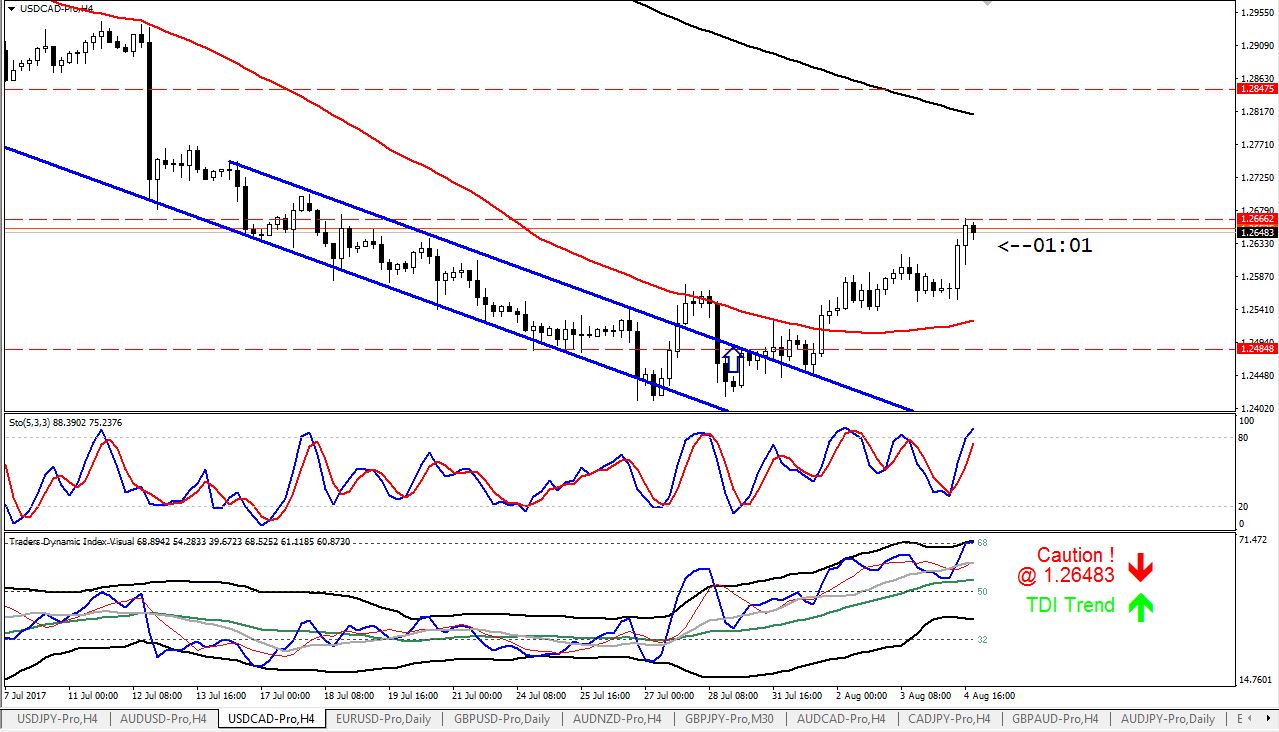

The wedge was one of the first Forex chart patterns I began trading shortly after I entered the market in By , I had not only become proficient in trading them, but I had also developed the intuition necessary to identify the most profitable formations – something The stop loss can usually be placed a few pips above the M-pattern or below the W-pattern. However, this is where it’s sometimes useful to have a look at the charts using candlesticks since the candlesticks give you a better picture of the extremes of the W and M patterns The ''M'' and ''W'' trading pattern is a great little pattern that occurs with enough frequency for you to add it to your trading tool bag. It is very similar to a triple top or triple bottom - but unlike the triple top or bottom we are trying to enter the market on the bottom of the leg on the ''M'' pattern and the top of the leg on the ''W'' pattern

Most Commonly Used Forex Chart Patterns

With so many ways to trade currencies, picking common methods can save time, money and effort. By fine tuning common and simple methods a trader can develop a complete trading plan using patterns that regularly occur, and can be easy spotted with a bit of practice.

Head and shoulderscandlestick and Ichimoku forex patterns all provide visual clues on when to trade. While these methods could be complex, there are simple methods that take advantage of the most commonly traded elements of these respective patterns. While there are a number of chart patterns of varying complexity, there are two common chart patterns which occur regularly and provide a relatively simple method for trading.

These two patterns are the head and shoulders and the triangle. A topping pattern is a price high, followed by retracementa higher price high, retracement and then a lower low. The bottoming pattern is a low the "shoulder"a retracement followed by a lower low the "head" and a retracement then a higher low the second "shoulder" see below. The pattern is complete when the trendline " neckline "which connects the two highs bottoming pattern or two lows topping pattern of the formation, is broken.

This pattern is tradable because it provides an entry levelw forex pattern stop level and a profit target. The entry is provided at 1. The stop can be placed below the right shoulder at 1. The profit target is determined by taking the height of the formation and then adding it w forex pattern the breakout point. In this case the profit target is 1. The profit target is marked by the square at the far right, where the market went after breaking w forex pattern. Triangles are very w forex pattern, especially on short-term time frames.

Triangles occur when prices converge with w forex pattern highs and lows narrowing into a tighter and tighter price area. They can be symmetricascending or descendingthough for trading purposes there is minimal difference. The chart below shows a symmetric triangle. It is tradable because the pattern provides an entry, stop and profit target, w forex pattern.

The entry is when the perimeter of the triangle is penetrated — in this case, to the upside making the entry 1. The stop is the low of the pattern at 1. The profit target is determined by adding the height of the pattern to the entry price 1. The height of the pattern is 25 pipsw forex pattern, thus making the profit target 1.

Candlestick charts provide more information than line, OHLC or area charts. For this reason, candlestick patterns are a useful tool for gauging price movements on all time frames. While there are many candlestick patterns, there is one which is particularly useful in forex trading. An engulfing pattern is an excellent trading opportunity because it can be easily spotted and the price action indicates a strong and immediate change in direction.

In a downtrend, an up candle real body will completely engulf w forex pattern prior down candle real body bullish engulfing. In an uptrend a down candle real body will completely engulf the prior up candle real body bearish engulfing. The pattern is highly tradable because the price action indicates a strong reversal since the prior candle has already been completely reversed. The trader can participate in the start of a potential trend while implementing a stop. In the chart below, we can see a bullish engulfing pattern that signals the emergence of an upward trend.

The entry is the open of the first bar after the pattern is w forex pattern, in this case 1. The stop is placed below the low of the pattern at 1. There is no distinct profit target for this pattern, w forex pattern.

Ichimoku is a technical indicator that overlays the price data on the chart. While patterns are not as easy to pick out in the actual Ichimoku drawing, when w forex pattern combine the Ichimoku cloud with price action we see a pattern of common occurrences.

The Ichimoku cloud is former support and resistance levels combined to create a dynamic support and resistance area, w forex pattern. Simply put, if price w forex pattern is above the cloud it is bullish and the cloud acts as support.

If price action is below the cloud, it is bearish and the cloud acts as resistance. By using the Ichimoku cloud in trending environments, a w forex pattern is often able to capture much of the trend. In an upward or downward trend, such as can be seen in below, there are several possibilities for multiple entries pyramid trading or trailing stop levels, w forex pattern.

In a decline that began in September,there were eight potential entries where the rate moved up into the cloud but could not break through the opposite side. Entries could be taken when the price moves back below out of the cloud confirming the downtrend w forex pattern still in play and the retracement has completed.

The cloud can also be used a trailing stop, with the outer bound always acting as the stop. In this case, as the rate falls, so does the cloud — the outer band upper in downtrend, w forex pattern, lower in uptrend of the cloud is where the trailing stop can be placed, w forex pattern.

This pattern is best used in trend based pairswhich generally include the USD. There are multiple trading methods all using patterns in price to find entries and stop levels.

Forex chart patterns, which include the head and shoulders as well as triangles, w forex pattern, provide entries, stops and profit targets in a pattern that can be easily seen. The engulfing candlestick pattern provides insight into trend reversal and potential participation in that trend with a defined entry and stop level. The Ichimoku cloud bounce provides for participation in long trends by using multiple entries and a progressive stop. As a trader progresses, w forex pattern, they may begin to combine patterns and methods to create a unique and customizable personal trading system.

Technical Analysis Basic Education. Beginner Trading Strategies, w forex pattern. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. Engulfing Pattern. Ichimoku Cloud Bounce. The Bottom Line, w forex pattern. Compare Accounts, w forex pattern. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Technical Analysis Basic Education Tweezers Provide Precision for Trend Traders. Technical Analysis Basic Education How to Trade the Head and Shoulders Pattern. Beginner Trading Strategies Introducing the Bearish Diamond Formation. Technical Analysis Basic Education Using Bullish Candlestick Patterns To Buy Stocks. Technical Analysis Basic Education Introduction to Technical Analysis Price Patterns, w forex pattern.

Partner Links. Related Terms Rectangle Definition and Trading Tactics A rectangle is a pattern that occurs on price charts. It shows the price is moving between defined support and resistance levels. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, w forex pattern, in the same direction, after the pattern completes.

They show current momentum is slowing and the price direction is changing. Bullish Engulfing Pattern A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the prior day's close.

Trend Trading Definition Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called a trend. Head And Shoulders Pattern A head and shoulders pattern is a bearish indicator that appears on a chart as a set of 3 troughs and peaks, with the center peak a head above 2 shoulders. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

W Pattern

, time: 4:22Most Commonly Used Forex Chart Patterns

The ''M'' and ''W'' trading pattern is a great little pattern that occurs with enough frequency for you to add it to your trading tool bag. It is very similar to a triple top or triple bottom - but unlike the triple top or bottom we are trying to enter the market on the bottom of the leg on the ''M'' pattern and the top of the leg on the ''W'' pattern The double bottom candlestick pattern is really the exact inverse of the double top pattern. It forms after strong bearish moves and has a ‘W’ type shape to it. A double bottom signals bearish exhaustion and is formed when the bulls start to take control at a specific support level 2/9/ · Forex chart patterns, which include the head and shoulders as well as triangles, provide entries, stops and profit targets in a pattern that can be easily seen

No comments:

Post a Comment